Buying costS in France

Quick Guide 2025

Purchasing a property in France involves more than just the asking price: notaire’s fees, property taxes, currency exchange rates, and other hidden charges can significantly increase the total cost. This quick guide highlights the key expenses every buyer should plan for, helping you approach the French property market with more clarity.

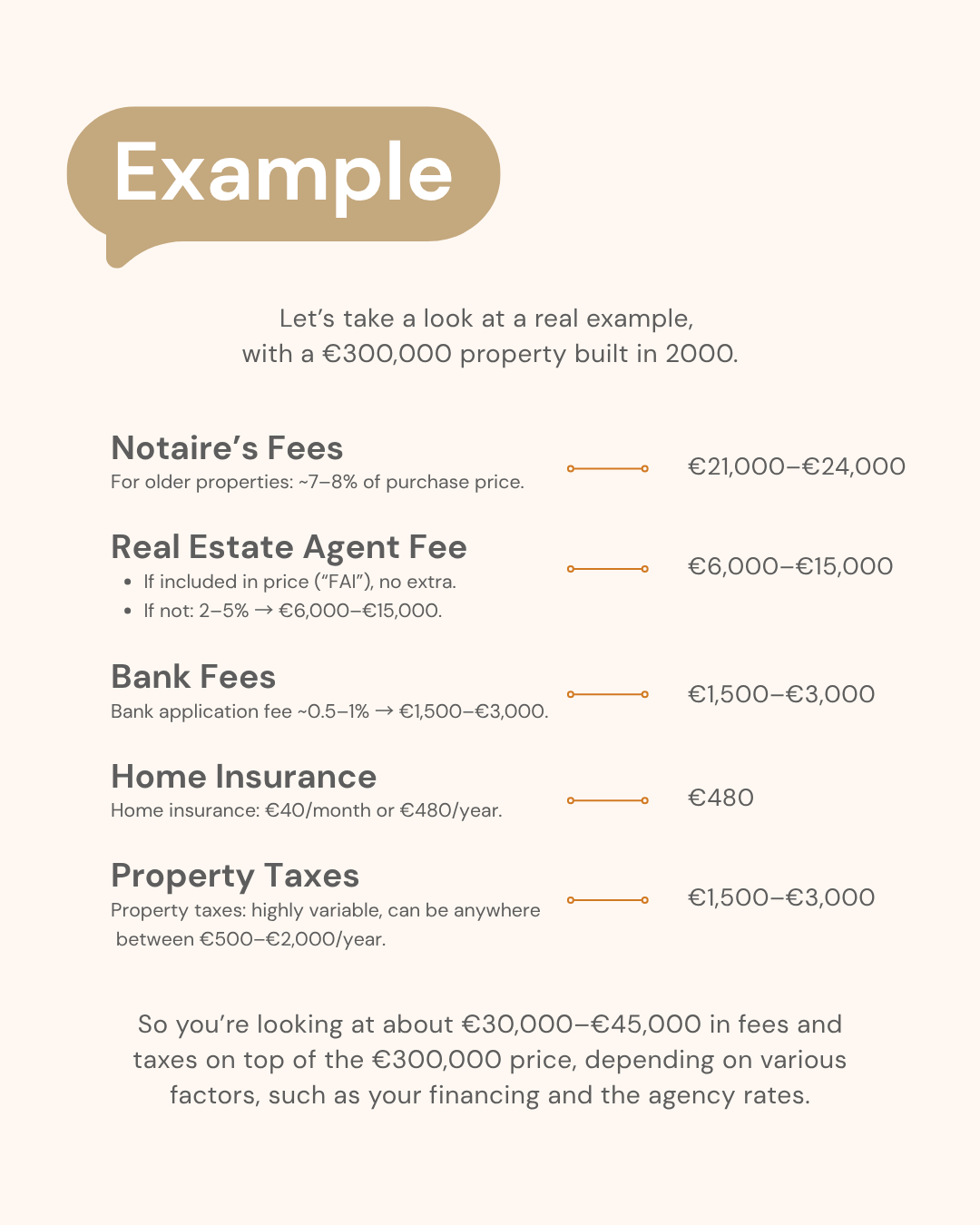

Notaire’s Fees

In France, purchasing an older property usually involves 7–8% of the price in taxes and fees, while for new builds the cost is generally lower, around 2–3%. Developers may also charge additional delivery fees.

These expenses include transfer taxes, administrative formalities, and the notaire’s role. Although commonly referred to as “notaire’s fees,” most of this amount is actually a nationwide tax, with rates set by the government.

Real Estate Agent Fee

Real estate agent fees are often included in the advertised asking price, marked as “FAI” (frais d’agence inclus). If they are not included, the buyer might be expected to pay between 2 and 5% of the purchase price, though the exact percentage can vary depending on the region and the agency.

These fees cover the agent’s services in marketing the property, handling visits, and negotiating the sale.

Bank Fees & Exchange Rates

When financing a property in France, banks usually apply several charges, including loan interest, application fees (around 1%), insurance costs, and any broker’s commission.

For international buyers, transferring funds in another currency is also an important consideration. Using a foreign exchange specialist generally provides a better rate than standard bank transfers, saving a small but meaningful percentage on large sums.

Pre-Sale Home Inspection (Optional)

In France, mandatory surveys (such as energy performance, asbestos, and lead reports) are the responsibility of the seller.

For additional peace of mind, buyers can commission a private survey to obtain an independent assessment of the property’s condition. This type of survey can reveal structural issues, hidden defects, or potential repair needs, and typically costs between €500 and €1,500 or more, depending on the property’s size, age, and complexity.

Home Insurance and Taxes

Beyond the purchase process, buyers in France should budget for ongoing ownership costs.

- Home insurance is compulsory and typically ranges from €15 to €40 per month.

- Property taxes apply annually; the notaire can provide the most recent bill for reference.

- Shared fees (“charges de copropriété”) may apply to apartments or shared developments, covering building maintenance, communal areas, and services.